Blog

Finances explained

Should I register my business as a Sole Trader or a Limited Company?

One of the first big decisions most entrepreneurs face when starting their own business is deciding whether to register as a sole trader or a limited company.

Choosing the best VAT scheme for your business.

Value Added Tax (VAT) can be a complex area for many businesses. Choosing the right VAT scheme can significantly affect your cash flow and compliance requirements. This article will guide you through the various VAT schemes available, helping you determine which one...

What is a payment on account?

If you receive income that isn’t taxed at source, you’re probably familiar with self-assessment tax returns. However, one aspect that often causes confusion is the requirement to make a "payment on account". Payments on account ensure that taxpayers contribute towards...

Essential bookkeeping tips for sole traders.

As a sole trader, managing your own business can be both rewarding and challenging. One of the most crucial aspects of running a successful business is maintaining accurate and up-to-date financial records. Effective bookkeeping ensures you can track your income and...

How should I run my serviced accommodation business?

The recent Airbnb era has resulted in more property owners letting their premises out on a short-term basis. The returns can be lucrative; however, the nature of short-term lets can incur unforeseen expenses. In this article, we will explore how some of these costs...

The vital role of an accountant in your hospitality business.

From managing daily operations to ensuring guest satisfaction, there are multiple aspects of a hospitality business that require careful attention. Amidst this intricate landscape, the role of an accountant becomes indispensable, serving as the financial backbone of your business.

How to price your menu to maximise profit.

As a pub or restaurant owner, pricing your menu correctly is crucial for maximising profits and ensuring the long-term success of your hospitality business. Finding the sweet spot between charging too little and pricing yourself out of the market can be a delicate...

Accounting tips for the hospitality industry.

If you own a pub, hotel or restaurant, keeping your accounts in order is essential for the success of your business. The hospitality industry is known for its fast-paced environment, high volume of transactions and unique accounting challenges. Proper accounting...

How can hospitality businesses improve their cash flow?

Maintaining a healthy cash flow is crucial for the success of any hospitality enterprise. Whether you own a pub, hotel or restaurant, you must ensure that there is enough money coming in to cover expenses, pay employees and reinvest in your business. Unfortunately,...

What are the tax benefits of holding property in a pension?

If you are a property investor or entrepreneur looking to diversify your retirement portfolio, holding property within a pension provides significant tax benefits. By taking advantage of these benefits, you can maximise your return on investment and secure a more...

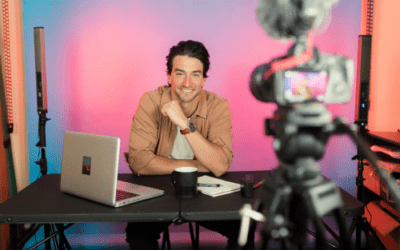

Do influencers have to pay tax on gifted items?

As a social media influencer, receiving free products and experiences are often part of the job. But what are the tax implications of receiving these gifts? As accountants, we often get asked by influencers if tax is due on PR gifts they receive. As with many areas of...

Do content creators need to pay tax in the UK?

If you are a content creator in the UK, earning money from platforms such as YouTube, TikTok, Onlyfans or Twitch, you might be wondering if you need to pay tax on your earnings from these platforms. The short answer is yes – when you start to make an income of over...

Contact us now for a professional service with a personalised approach.